The goal of operations is to allocate scarce resources to the highest value uses. This means defining priorities, concentrating resources on those priorities, and excluding sources of distraction and waste.

A. Defining Priorities

1. The Sales Equation

Start by understanding what levers you can pull to influence your team’s performance. You can think of your sales process as an equation in which inputs at a given stage are multiplied by conversion rates to produce outcomes. Those outcomes then become the inputs at the next stage in the sales process.

A simple version of the equation looks like this:

No matter how complex the details, every initiative you undertake ultimately aims to increase a quantity or a conversion rate listed in this simple sales equation.

2. The Sales Funnel

The sales equation is normally visualized the form of a sales funnel. The metaphor of the funnel captures the idea that many prospects start your sales process at the wide top of the funnel. Through your sales efforts, you move some fraction of these prospects through each stage down the funnel. It narrows at each stage until it arrives at the number of closed deals.

The sales funnel has two goals. First, it should highlight problem areas. These are stages in your sales process where prospects fail to convert to the next stage or where there are too few prospects flowing into the stage. Second, it should allow you to forecast future sales. You can take the prospects toward the bottom of your funnel and apply the observed conversion rates to estimate your upcoming revenue.

Good funnels usually have a few traits. For one, they use objective criteria decide when a prospect advances from one stage to the next. An objective criteria is measurable, such as whether a prospect approves a post demo action plan to move the sale forward. By contrast, whether a salesperson feels like the prospect is serious about moving forward after a demo is not an objective criteria.

Good funnels also separate active opportunities from dormant ones. Many prospects never actually say no, they just go quiet. After a certain period of silence, these opportunities aren’t worth much effort and shouldn’t be in your sales forecasts. Finally, good funnels strike the right balance between providing the information you need while also being as simple as possible.

You can use the funnel design below as a starting point. There are three portions: (1) active prospects, those that you focus your resources on; (2) dormant prospects, those that have gone quiet or requested that you reach out in the future; and (3) final statuses, which list the outcomes in your sales process.

To make this funnel complete, you’ll have to answer two additional questions. First, what standard must a lead meet to be qualified as an opportunity? Second, how long can an active prospect be silent before you move it to dormant status? Different standards will be appropriate for different companies but the standards should always be as objective as possible. You want optimistic salespeople but you don’t want their optimism to throw off your sales forecasts.

You can have either tight or loose standards for qualifying a lead. A tight standard might require that you have confirmed that your contact has budget to make the purchase, the authority to make the decision, the need for the product, and the desire to make a decision in a short period of time (known as BANT). A loose standard might merely require that the person you talk to has interest in the product, influence over the decision, and that their company needs the product.

Whether you choose a tight or a loose standard depends primarily on how many opportunities you have in your pipeline. If your sales team is overwhelmed by demos, tighten your qualification standards to focus their limited time on the best prospects. If they’re not busy, loosen the standard. You might also consider how much time you have to commit to a sales process and how valuable the opportunity is. If a sales process takes very little time and could result in big sales, you can loosen the qualification standard.

You can also choose either tight or loose standards for determining when an opportunity has gone dormant. Experience will show you that there’s a point past which a silent prospect seldom becomes active again. You might send them some mass emails every month or two, but it’s not worth calling them every week anymore to to see if they want to go forward. Set a time period for each stage and modify it as you get more experience.

3. Metrics

Having defined the stages in your sales process, you can start to measure results. Good metrics let you make decisions based on hard evidence rather than your recollection of your last five sales conversations.

But there’s a point of diminishing returns. Don’t waste your time measuring 500 metrics for your three person sales team just because metrics are fashionable. Indeed, imposing scarcity can lead to better thinking. If you’re only going to track a limited number of metrics, you have to decide what is most important. Making those priority judgments will compel you to clearly understand your sales process and its challenges.

Think of metrics as falling into three categories depending on their importance to your operations.

- Core: These are your most important metrics. You have them memorized and you’d use them to summarize your results if you ran into a colleague in the hallway and he asked you how sales were going.

- Reported: These are important but not as important as your core metrics. You circulate these numbers periodically and can access them with a few clicks. You consult these numbers regularly when you’re trying to get to the bottom of a difficult issue.

- Gathered: You collect these metrics because you have the sense that they might come in handy and they’re easy to gather. You can pull them up and analyze them on an as needed basis, but they’re not necessarily part of your regular decision making process.

The number of metrics you collect in each category depends on the sophistication of your data gathering and analysis tools. If your tools are rudimentary, you’ll focus on a small number of core metrics and collect relatively little else. Gathering data in Google Sheets interrupts workflows and analyzing it by hand in Excel takes a lot of time. If you start by analyzing the most important, easiest to collect metrics, every additional metric adds less value and takes more time than the one before.

There comes a point at which the value of adding an additional metric is outweighed by the cost. Try to find the optimum point by adding metrics only when they yield benefits net of their costs.

If you have more advanced tools like Salesforce, you can expand your reported and gathered metrics sets. Technology makes data easier to collect and analyze. It doesn’t, however, make you smarter. It also doesn’t lessen the benefit of forcing yourself to decide which metrics are really the most important. As a result, your core metrics set will expand much less than your reported and gathered sets.

Now it’s time to choose your specific metrics. Work backwards from the decisions you need to make and build your core metrics set to inform those decisions.

Every company will need to decide what stage in its sales process most demands attention and improvement. Your metrics should give you a sense of how you’re doing at four basic tasks:

- Generating activity

- Generating interest

- Completing demos

- Closing deals

You’ll gather two types of numbers: counts and rates. Counts measure the number of events that occurred, like the number of demos you conducted. Rates measure the percentage of activities that caused a deal to advance to the next stage, like the conversion rate of demos to closed deals.

Rates must be time bound. For example, you might determine what percentage of demos conducted in January resulted in closed deals before April 1st. This measures a defined activity, demos in January, and gives the activity a fair chance to convert to the measured outcome.

Start with the minimum possible set of metrics and build from there. The minimum counts are:

- Touches (such as outbound calls or e-mails)

- Leads created

- Demos completed

- Deals closed

The minimum conversion rates are the percentage of:

- Touches converting to leads

- Leads converting to demos

- Demos converting to closed deals

Next, expand your metrics set so that you can evaluate each of the major activities you’re undertaking. Evaluate both the quantity of activity and the level of success. What counts as “major” depends on the shape of your operations. You want to separately measure experiments you’re running and to separate the results from each major sales channel in your normal sales process. The more advanced your tools, the broader and more detailed the set of activities you can measure.

The most general measurements are typically categorized as core, more detailed ones are normally reported, and the most granular are usually gathered. Let’s say you have advanced metrics tools and you engage in both outbound calls and emails. You’d measure outbound calls separately from e-mails. The count of calls and their conversion rate to lead for your entire team would be core, the count and conversion rate for each salesperson would be reported, and the success rate based on time of day for the call might be gathered. If you didn’t have advanced tools, you’d skip the success rate based on the time of day.

You can add metrics in six ways, each of which may be useful depending on the questions you’re trying to answer. You can:

- Divide a count by the type of activity. Touches can be divided into calls, emails, and website visits.

- Divide a conversion rate by the type of activity. Conversions of touches to leads can be divided based on the type of touch, such as the percentage of calls converting to leads.

- Divide a count or rate based on a trait of the actor, the person performing the action. For example, you can measure counts or rates for each salesperson.

- Divide a count or rate based on a trait of the activity. For instance, you might test a particular message in your outbound e-mails.

- Divide a count or rate based on a trait of the recipient. For instance, you could divide your call counts by the size of the company called or the title of the person you’re calling.

4. Setting Priorities

Using this data, define your 1-3 most important problems. These will be the focus of your efforts; everything else you’ll save for later.

The ideal problem, if there is such a thing, is one that has both a high payoff if solved and a high probability of being solved. If you can’t fix it or it’s not high payoff, let it be. Look for team or company level problems rather than individual problems. Make your description of the problem specific enough to be actionable. For example, “increasing lead flow” is an actionable, team-wide problem. Helping one sales rep close more effectively is not a team-wide problem. “Increasing sales” isn’t specific enough to be actionable.

Limiting your list of problems to three forces you to concentrate your resources rather than uselessly dividing them among 50 issues. Keep track of which problems did not make your final list and write down the reasons why you decided not to include them. When these problems crop up, remember that you decided to let them be and concentrate on your top priorities.

Here are a few guidelines:

- Fix problems at the top of the funnel first. If you can’t get prospects into your sales process, you never get to play the sales game.

- Look for bottlenecks. You may have a lot of leads but few demos. Solving that bottleneck could have huge returns.

- Make use of slack resources. If your AEs don’t have enough demos to do, switch them over to prospecting.

- Look for benchmarks to see how your counts and rates stack up. No two companies are the same but no company should view its data in a vacuum.

5. Crystallizing Priorities: Objectives and Key Results

Turn your priorities into a plan by preparing a list of Objectives and Key Results (OKRs). OKRs are a list of 3-5 objectives each of which has attendant measurable key results and actions.

Go back to the problems you identified above and start with your highest priority. Break down the steps to a solution and incorporate those into your objectives. You might be able to tackle several of the major priorities you identified.

Try to include both key results and specific actions for each objective. If you list only key results, your OKRs become a wish list. If you list only actions, your OKRs are a glorified to do list. If you have a team, create a set of OKRs for the team and one for each member of your team that supports the team set.

OKRs have a time horizon: You aim to accomplish the objectives by a specific date. Choose a time horizon that fits your company’s stage. If the time horizon is too long, you’re trying to plan for a future you can’t predict. If it’s too short, your OKRs are just improvisation dressed up as planning. Discovery stage companies should have OKRs for about the next month. Scaling stage companies might opt for 2-3 months.

B. Allocating Resources to Top Priorities

Concentrating resources on your top priorities will be difficult because of constant crises, interruptions, and proposals for new initiatives. These are some techniques you can use to improve your ability to concentrate on top priorities.

1. Structure

It’s natural to follow the path of least resistance. A good structure ensures that the path of least resistance concentrates resources on top priorities rather than wasting them on diversions.

Structure has two elements: (1) defining a schedule that sets aside regular blocks of time for specific activities and a focuses on top priorities, (2) narrowly defining what constitutes an emergency that would justify an interruption to the schedule.

Each person’s schedule depends on his role. Sales teams typically have three roles, each of which has a core task: (1) managers focus on improving team performance, (2) AEs focus on closing customers, (3) SDRs focus on generating interest.

Therefore:

- Manager days are built around major projects. These include diagnosing problems in the funnel, designing experiments, and creating training programs. Meetings slot into these blocks of time. Managers also set aside time for office hours: designated periods when team members can ask important but not urgent questions.

- AE days are built around software demos and blocks of time for catching up with prospects to move deals forward.

- SDRs days are built around prospecting and have long blocks of time set aside for calls. Long blocks of time work best for calls because calls are difficult and SDRs will be tempted to let other activities encroach on calling time.

- All team members have a half hour meeting in the morning to ask questions and review their plan for the day.

- All team members have designated periods for catching up on emails. Most emails are not urgent and shouldn’t divert you from higher priority tasks. Setting aside email catch up periods ensures that you deliver prompt responses without losing your flow.

Here’s a full schedule that implements these priorities:

2. Preventing Unwarranted Interruptions

Unwarranted interruptions waste both the time you spend on the interruption and also the time it takes you to mentally switch gears between tasks. But some interruptions provide information or ideas you desperately need. You to efficiently filter out the first while preserving the second.

Begin by defining what constitutes an emergency. Your colleagues should feel free to interrupt you with emergencies anytime but everything else is best left for office hours or a quick email. Normally, you should only be interrupted about deals that could imminently close.

Next, delegate authority on secondary matters and create clear guidelines to govern the delegated authority. Support your team members if they make a reasonable choice that turns out badly.

Let’s say your team’s top priority is increasing customer count and you care a lot less about your profit margins. You don’t want to spend a lot of your time on pricing negotiations. You could establish a policy that your team may cut prices by up to 20% without your approval. The discount lowers the salesperson’s commission by a set formula. With that policy in place, you can focus on getting more customers in the door.

The most difficult interruptions are from colleagues who have good ideas that aren’t worth prioritizing right now. These tug on your heartstrings: It’s awesome that they’re trying to be helpful. But you can’t devote resources to an unwarranted project in order to show your appreciation.

If the idea doesn’t relate to an OKR, thank your colleague and let them know that you’re deferring action on their idea because it’s not one of your OKRs. If you think the idea is good, ask them to summarize it in an email for you so you can refer to it later. This way, you’ve shown your gratitude and given a good reason for leaving the issue till later.

3. Avoiding Waste: Threshold Effects, Diminishing Returns, and Hopeless But Alluring Causes

Devote the right level of effort to each project, even if the right level is zero.

Some projects are subject to threshold effects: The project yields no return unless the level of effort exceeds a given threshold. You should either exceed the threshold or not do the project at all.

For example, it’s easy to pull off a hacky webinar but very hard to pull off a good one. Good webinars require thoughtful promotion, content directed toward a specific target audience, and a clear plan for turning attendees into customers. Good webinars can generate returns.

But hacky webinars usually don’t. Attendance is low and the conversion rate is minimal. So be honest with yourself: If you don’t have the resources to pull off a good webinar, don’t do one at all.

Other projects are subject to diminishing returns. Once you hit a certain level of effort, additional effort yields very little return. So hit that level of effort and move on.

Prospecting emails are a good example. Once you have the basics down (like the right length, subject line, hook, and proof of value), incremental increases in e-mail quality generate very little additional return. So just hit send and forget about it. Similarly, with most blog posts, a lone typo won’t kill you so there’s no need for ten rounds of line edits.

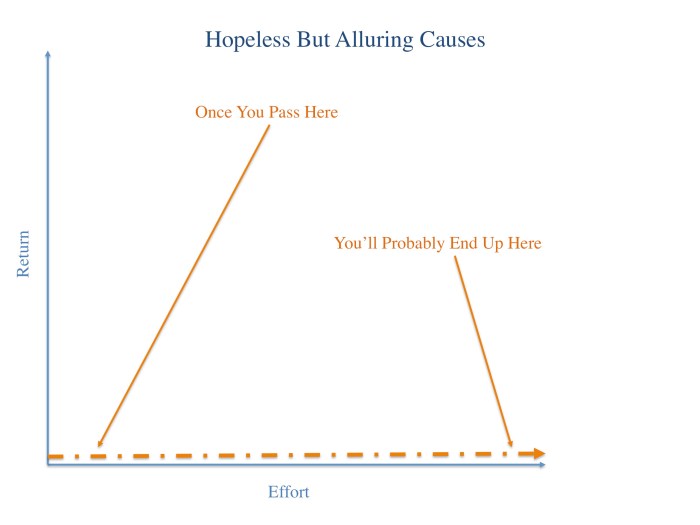

Other activities are hopeless but alluring causes. These offer a chance at a large return but have nearly zero chance of success. The trouble is that they’re hard to say no to because nobody wants to say the cause is hopeless. After all, you believe in your product and being an entrepreneur is all about beating the odds. Once you start the project, you realize that the return is all or nothing; either you succeed or fail and get no benefit. So you pile on more and more resources to get over the success threshold.

But it’s a mirage: You’re just marching deeper and deeper into the desert of wasted effort.

Responding to requests for proposals (RFPs) is often a hopeless but alluring cause. RFPs are rigged: The prospect has a preferred vendor in mind and probably let the preferred vendor write the requirements. Don’t submit a response unless you are the preferred vendor and have either been told that you’re the prospect’s first choice or have written the requirements.

It’s not enough if the prospect has encouraged you to submit a proposal. Prospects love getting proposals from vendors they have no intention of buying from. Extra proposals give the prospect negotiating leverage over their preferred vendor and make it clear to others in their company that they’ve done their due diligence. It costs the prospect nothing to encourage you to submit a proposal. On the other hand, it costs you a lot to prepare the proposal and you could have used that time to close other customers.

Prospects that are much larger than any of your current customers are usually hopeless but alluring causes. You can get meetings with them. People love to talk to smart startup entrepreneurs. Heck, they’ll probably say a lot of nice things to you. But they won’t buy from you.

Big companies care a lot about risk. If you don’t have a track record with companies like theirs, they will see you as a big risk. They’re right to feel that way: Larger companies typically have different and greater demands than smaller ones.

Larger companies are also more likely to follow a formal process when they purchase, which both increases your cost to participate and lowers your odds of success. Formal processes involve considering multiple alternative vendors and holding multiple rounds of meetings with each vendor. You might make the final round because of how impressive you and your product are, but, in the end, the committee making the decision will go with the safe choice. That’s not you.

(This is the third part of a four part article on running sales at a startup. You can find the first part here and the second part here.)